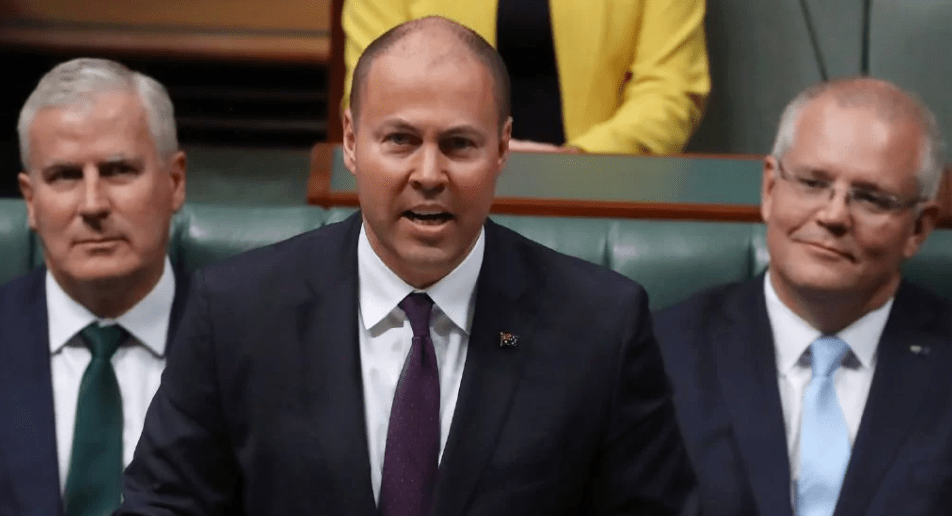

The federal government has released its budget, with Treasurer Josh Frydenberg forecasting a $7.1 billion dollar surplus in 2019-20.

The Treasurer’s first budget includes an increase to the instant asset write-off threshold as well as expanded eligibility, tax relief, and more funding for training, along with changes to visa fees and funding for mental health services.

Instant asset write-off threshold

Around 3.4 million businesses will be eligible for the instant asset write-off, with access expanded to include medium-sized businesses with an annual turnover of less than $50 million.

“This will cover an additional 22,000 businesses,” says Frydenberg. “More than 350,000 small businesses have accessed the instant asset write-off and now we expect more to do so.”

Additionally, the threshold will be increased from $25,000 to $30,000. This builds on the already announced increase from $20,000 to $25,000.

The changes came into effect on Tuesday 2 April and will remain accessible until 30 June 2020.

“It can be used every time an asset under that amount is purchased, allowing a café to get a new fridge or grill,” said the Treasurer in his budget night address.

Tax cuts

Businesses with a turnover of less than $50 million will also benefit from a tax cut, with the current 27.5 per cent rate dropped to 25 per cent by 2021-22 — five years earlier than planned.

The unincorporated small business tax discount will also see an increase, from 8 per cent to 13 per cent in 2020-21 and to 16 per cent from 2021.

Training

The VET sector is set to receive $525 million over five years.

Part of this funding will go towards the introduction of an Additional Identified Skills Shortage Payment, which is set to create 80,000 apprenticeships. The package includes incentive payments of $8,000 per placement for businesses (up from $4,000) and $2,000 for apprentices in specific industries.

Eligible occupations will include bakers and pastry cooks, with the list to be reviewed annually.

The government will establish a National Skills Commission to oversee $2.8 billion annual investment in VET. Driving research and analysis of future skills needs across industry to ensure national labour market priorities are addressed will be a key function of the Commission.

While it welcomed the increased spending in the sector, industry body R&CA said the employer incentive should be widened to cooks, chefs and café and restaurant managers which are occupations that have significant shortages.

Visa fees

The base visa application charge (VAC) for all visa subclasses (except for visitors), will be increased by 5.4 per cent from 1 July 2019.

The reduction in annual migration cap from 190,000 to 160,000 is also confirmed by the budget.

“We continue to have concerns over the government’s plan to reduce permanent migration,” says Juliana Payne, CEO of R&CA.

According to R&CA, 47.3 per cent of their business-owners reported experiencing difficulties in filling positions last year.

“The forecast employment growth for the sector is for an additional 74,700 jobs by May 2023, and without skilled migration, the industry simply will not have enough people,” says Payne.

“The announced 5.4 per cent increase in all visa fees except for those visiting Australia will also make this more expensive.”

Mental health

In a 2018 survey conducted by R U OK?, 80 per cent of hospitality workers agreed mental health issues are a challenge for the industry.

“Mental health is an issue of deep concern to all Australians,” says Frydenberg. “This issue demands our ongoing attention and resources.”

Services for people living with mental illness will be bolstered by $737 million over seven years. The amount includes $461 million for youth mental health and suicide prevention.

Headspace will receive $111 million for 30 new centres by 2021, while $152 million will be provided to reduce waiting lists for the foundation.

Additionally, $115 million will be provided to trial eight mental health centres, which will offer support for adults requiring treatment.

Labor will deliver its response to the budget on Thursday 4 April, with Prime Minister Scott Morrison expected to a call an election for late May. In order to deliver its budget promises, the Coalition will need to win re-election.